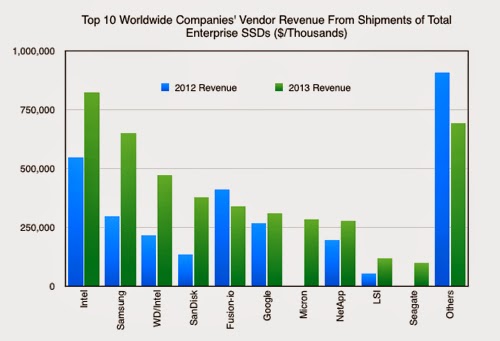

A recent survey by Gartner (see below) shows Intel and Samsung leading in shipment of SSD storage for enterprise.

Ron

Insightful, timely, and accurate semiconductor consulting.

Semiconductor information and news at - http://www.maltiel-consulting.com/

Insightful, timely, and accurate semiconductor consulting.

Semiconductor information and news at - http://www.maltiel-consulting.com/

Gartner AFA data hits the street

By Chris Mellor, 13 Jun 2014

No,

it isn’t the greatly anticipated all-flash array magic quadrant, but it's great

Gartner analysis nonetheless. The number-crunchers at Gartner HWQ have produced

a Market Share Analysis: SSDs and Solid-State Arrays, Worldwide, 2013. Yummy.

Let’s see what’s inside.

The

doc, available as a download from Pure Storage (guess who's

done well in the analysis) after registering a few details. It looks at both

SSDs and all-flash arrays, which Gartner calls Solid State Arrays (SSAs) and

IBM comes out as the leading SSA shipper – with Pure Storage second.

SSAs

are defined carefully: ”SSAs are scalable, dedicated, solutions based solely on

solid-state semiconductor technology for data storage that cannot be configured

with HDD technology at any time. As distinct from SSD-only racks within ECB

storage arrays, an SSA must be a stand-alone product denoted with a specific

name and model number, which typically (but not always) includes an operating

system and data management software optimised for solid-state technology.”

To

cut a long story short, Dell and HDS all-flash array products are excluded, as

are all-flash versions of – for example – EMC VMAX and VNX, and NetApp FAS

arrays.

The

SSD category embraces PCIe flash cards and also includes “self-contained

solid-state NAND dual in-line memory modules (DIMMs), which must be used in dedicated

slots in servers. Mainstream PC SSDs being used in servers are counted in this

category due to end consumption.”

We’ll

graph the information here, and you can read the detailed numbers by

downloading the doc. The SSD info starts with worldwide vendor revenues:

Click chart for larger version

Total

SSD revenues in 2012 were $7.2 billion, and in 2013 had risen to $10.99

billion, a 53.1 per cent increase.

Samsung

as top dog got most of that with Intel, growing less, at number 2. Look at

Sandisk’s rocketing growth up into the no 3 slot, closely followed by Micron.

Toshiba held its fifth place but didn’t grow much. WD grew, Fusion-io declined

and now we’re in the tail-enders.

Now

let’s look at the enterprise SSD market:

Intel

is top dog, not second-placed Samsung. WD, with its HGST/Intel SSDs is in third

place followed by SanDisk successfully exhibiting its enterprise supplier

credentials. Then there’s Fusion-io, which declined 2012 - 2013, Google with

its internal use - amazing - Micron is a, we think, in a disappointing sixth

place, NetApp a, for it, strong seventh then LSI and Seagate. EMC does not

appear at all.

Now

for the SSA numbers.

Here

are the vendor revenue market share numbers:

Click chart to make it larger.

And

here the actual SSA revenues by vendor:

Click chart to make it larger

IBM

has had a wildly successful 2013 year, solidly overtaking Violin Memory to

claim a dominating number 1 slot. Pure Storage has rocketed to the number 2

position in 2013 while Violin Memory slumped from first place in 2013 to third

in 2013, illustrating the new management team’s uphill task. EMC has sprung

into fourth place from a standing start and NetApp is not far behind in the

fifth slot. Then there’s Nimbus Data and tail-ender Cisco - a dismal showing

for the networking behemoth in our view, with startup SolidFire very close

behind.

The

SSA market was sized by Gartner at $236.5m in 2012, and 182.1 per cent higher

at $667.3m in 2013. IBM’s SSA revenues grew at 278.1 per cent, Pure's at a

magnificent 642.3 per cent and no other vendor outpaced the market, meaning

they lost share.

Now

this is artificial, as EMC, Kaminario, SolidFire and HP had no presence in

Gartner’s numbers in 2013, but we can assert that Violin Memory, NetApp, Nimbus

and Cisco all lost share from 2012 to 2013. With EMC, Kaminario, SolidFire and

HP now in the SAA market we might expect these losses to continue in 2014.

The

Gartner analysis contains more data, segment metrics and so forth. It’s worth a

download and read if you’re interested.

Main takeaway? Big Blue

really is big in SSAs, Pure Storage is living up to its hype, and the SSA

market is growing at a fast lick. NAND the story goes on

No comments:

Post a Comment