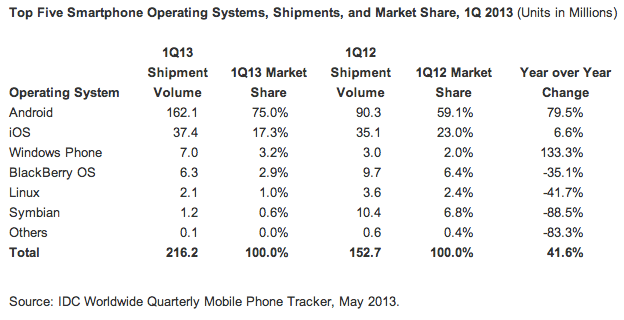

Statistics about operating system market shares of smart phones in first quarter of 2013 are detailed below.

Statistics about operating system market shares of smart phones in first quarter of 2013 are detailed below."Android OEMs shipped 162.1 million handsets in the quarter, giving the platform a 75% share of total worldwide shipments, while Apple’s 37.4 million devices"

More Smartphone/ OS Market share: Apple, Samsung, HTC...

Samsung Galaxy S4 will increase Androids' second quarter market shares.

Ron

Insightful, timely, and accurate semiconductor consulting.

Semiconductor information and news at - http://www.maltiel-consulting.com/

IDC: Android OEMs Shipped 162M Smartphones In Q1, More Than 4X Apple’s Rate; Windows Phone Now In (Distant) Third

INGRID LUNDEN posted yesterday

That meant that Microsoft has now overtaken BlackBerry, which declined by just over 35% with 6.5 million shipments, ending with a 2.9% market share.

Important to note that IDC specifies that this is devices shipped, not sold. Some analysts have told me that the two are effectively interchangeable terms, but shipped is also potentially a more optimistic figure: it points to how well retailers and carriers think certain models are likely to sell in the quarter ahead. Occasionally these can lag compared to how well certain handset makers are actually doing if a device ends up selling worse than expected.

What “shipped” numbers like IDC’s say is that Android and iOS continue to, more or less, remain the only games in town in terms of how confident sales channels feel about shifting devices, with other platforms relegated to niche status. This is something that companies like BlackBerry are trying to change, as evidenced by a recent deal to extend a $256 million loan to Telefonica for purchasing BlackBerry devices.

IDC’s numbers show that together these two platforms accounted for nearly 200 million units (199.5 million) shipped, up 59% over a year ago. The smaller players are not to be dismissed, though. Not only is Windows Phone the most rapidly rising of all platforms at the moment, but IDC notes that BlackBerry’s BB10 new range have hit 1 million shipped devices this quarter.

But turnaround will only come with that kind of growth being sustained. “Given the relatively low volume generated, the Windows Phone camp will need to show further gains to solidify its status as an alterative to Android or iOS,” writes Kevin Restivo, senior research analyst with IDC.

For the time being, the message to users, and to app developers, is that these are the platforms where you want to be. Considering how key content has been as a route to attracting users to these devices, that will continue to pose a challenge for the smaller players.

As with Strategy Analytics’ numbers yesterday detailing the profitability of different smartphone platforms in the quarter, IDC notes that Samsung is by far the “clear leader” in Android. It notes that it had a 41.1% market share. As a sign of the ongoing fragmentation of players on the platform, no other single OEM had more than a single-digit percentage market share after that, “and an even longer list of vendors with market share less than one percent.” The fact that it’s still “free” to license Android, and relatively easy to modify it for a more custom experience, will mean that it will continue to be the platform of choice for OEMs looking for more revenues from the ongoing boom in smartphones.

As we saw in Apple’s earnings earlier in the quarter, the company’s sales of iPhones are at an all-time high, but in comparison to the growth of the rest of the market, it’s actually off, with market share down nearly six percentage points. There is some feeling that part of this is due to the fact that the platform appears stale compared to all the change going on elsewhere with software and hardware features, news handsets and more. “Although demand remains strong worldwide, the iOS experience has remained largely the same since the first iPhone debuted in 2007,” IDC notes, pointing to a “massive overhaul” that appears to be on the cards with iOS 7.

IDC also notes that over the last year, shares of the biggest platforms have fluctuated, although Android’s current 75% is the highest in a year. Against that, the last time that Android approached 75%, in Q3 2012, Apple’s share was only 14.5% as people held out for a new iPhone model. That shows that Apple’s growth this quarter was at the expense of declines for other smaller platforms.

photo: flick

r

r

No comments:

Post a Comment